Probate Law

Trust Us With Your Probate Needs

_____________

Have a question about your will or trust but don’t know where to start?

Mobile Estate Planning

We’ll Come To You

_____________

Have a question about your will or trust but don’t know where to start?

PROTECT YOUR FAMILY

PROTECT YOUR FAMILY

What Is Probate Law in Indiana?

The loss of a loved one is always a difficult time in your life. However, that difficulty can be exacerbated by the post mortem process referred to as probate. Our firm specializes in probate law, and is here to help walk you through any planning, administration, or litigation services you may need.

The duration of a probate court procedure might range from months to perhaps years. That’s probably the last thing you want your loved ones to go through just after your passing. And if you don’t have a plan, your family may have to deal with potentially disastrous consequences beyond only the financial and emotional toll on them.

You cannot put off asset protection planning until a crisis arises. It may be too late to preserve your assets once you are facing a lawsuit. Your asset protection measures must be in place far in advance of an event for them to be effective, just like all other types of planning. Your asset protection strategy also needs to be revised on a regular basis to take into account changes in your assets, family dynamics, and legal requirements.

The probate process is complex and can be overwhelming to many, but can be separated into a few steps.

The executor must first submit a request for probate in the county of the decedent. The court will publish notice of the application for probate after it has been filed. Whether you have a will or not, everything that happens during probate is recorded and made available to the public. This means that anyone with a desire can discover the specifics of your estate, your beneficiaries, and what they will inherit, making them possible prey for con artists and fraudsters.

The court will then decide whether the deceased had a valid will after that. The court will choose the executor named in the will if the will is present and declared valid. If a will does not specify an executor (or the named person cannot or does not want the job), the court will determine the best fit for an executor of the estate.

The estate executor will need to locate all estate assets, determine all beneficiaries, notify any known creditors, and work to resolve any disputes among heirs and beneficiaries. Probate may lead to arguments between your family members. This is especially true if you want to disinherit someone or leave one relative a sizable financial inheritance over the others, in which case a family member might challenge your will. Even if those legal battles are unsuccessful, your family will still have to deal with more time, money, and stress as a result of them.

After locating all assets, the executor or personal representative must inventory all property to determine the value of the estate. If the value of the estate does not contain enough assets to pay off creditors, beneficiaries may receive reduced or no inheritance.

It’s crucial to note that even if you have a will in place, your loved ones will still have to go through probate after you pass away. Therefore, you cannot rely exclusively on a will and must implement extra estate planning tools if you want to prevent your family from going to court and getting into a fight after you pass away.

The process can be significantly more effective, saving time and money, with the help of a lawyer with experience in estate planning.

Call our firm today for more information.

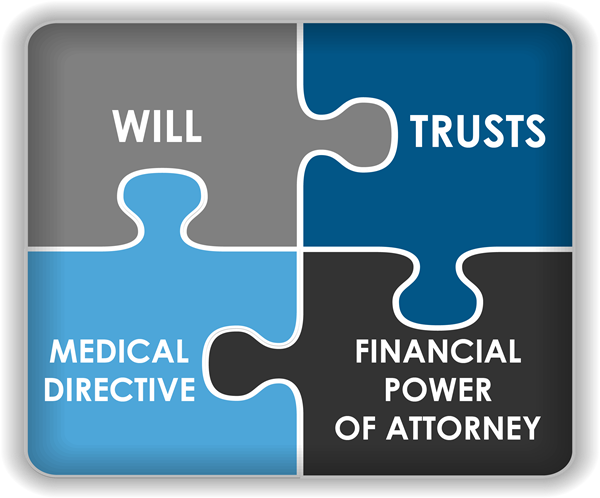

What Documents Can We Prepare?

What Documents Can We Prepare?

Foundational Documents

A Will

Financial Power Of Attorney

Medical Power Of Attorney

A Living Will (also called an Advanced Directive)

Living Trusts

Irrevocable Trusts and Revocable Trusts

Asset Protection Trusts

Real Estate Trusts

Special Needs Trusts

Educational Trusts or Student Fund Trusts

Pet & Gun Trusts

Beneficiary’s Deed

Also called a “Transfer On Death Deed.” You name the beneficiaries that will receive any real estate property upon your death. A beneficiaries deed is paired with your living will. This is a great method for avoiding probate and transferring real estate without a trust. Always consult your estate planning attorney.

Ali Saeed

Estate Planning Attorney

Advising You Step By Step!

We work together with our clients to make sure your wishes are carried out, so although we provide important estate planning documents, we are not just document producers. We care about our clients well-being, and hope our clients too feel the same. I look forward to connecting!

Ali Saeed

Estate Planning Attorney

Advising You Step By Step!

We work together with our clients to make sure your wishes are carried out, so although we provide important estate planning documents, we are not just document producers. We care about our clients well-being, and hope our clients too feel the same. I look forward to connecting!

What Clients Say About Ali

⭐️⭐️⭐️⭐️?

Would you rather talk with an attorney before scheduling?

Request A Callback

Would you rather talk with an attorney before scheduling?

Request A Callback

Ali will call you back shortly.

Questions Your Attorney Will Ask…

Questions Your Attorney Will Ask…

✅ List of Assets, including approximate value – if you have investment assets, please bring a recent statement from the brokerage house that holds the assets

✅ A recent bank statement

✅ List of names, addresses, and phone numbers for those to whom you plan on leaving assets in a will – usually this is children, relatives, or even charities

✅ A copy of the deed to any real estate you own – if you can find it

✅ Decide who you want to use as your agent under a power of attorney, and that person’s name, address, and phone number, if not included above

✅ Decide who you want to be in charge of distributing your assets upon your death, including that person’s name, address, and phone number, if not included above

✅ List of Assets, including approximate value – if you have investment assets, please bring a recent statement from the brokerage house that holds the assets

✅ A recent bank statement

✅ List of names, addresses, and phone numbers for those to whom you plan on leaving assets in a will – usually this is children, relatives, or even charities

✅ A copy of the deed to any real estate you own – if you can find it

✅ Decide who you want to use as your agent under a power of attorney, and that person’s name, address, and phone number, if not included above

✅ Decide who you want to be in charge of distributing your assets upon your death, including that person’s name, address, and phone number, if not included above

Book Now

In-Person, Audio or Video Conference

Would you rather talk with an attorney before scheduling?

Ali Saeed will reach out to you shortly.

Ali Saeed will reach out to you shortly. Complete this form to send us a message. Everything submitted through this form is fully confidential and we will reach back out to you promptly.

Complete this form to send us a message. Everything submitted through this form is fully confidential and we will reach back out to you promptly. Book A Call With Eric

Book A Call With Eric