What to Expect with Saeed & Little

Your Dedicated Team

_____________

Have a question about your will or trust but don’t know where to start?

PROTECT YOUR FAMILY

PROTECT YOUR FAMILY

What to Expect with Saeed & Little

No matter if this is your first time working with an estate planning attorney or not, it’s essential to understand how working with us differs from working with a conventional attorney.

Here, we’ll outline our procedure in the hopes that it will motivate you to contact us, and determine what your family needs you to have in place in order to avoid leaving a mess behind if you become incompetent or pass away. We guarantee to help you develop the wisest, most inexpensive, most effective, time-saving strategy for yourself and the people you love.

An initial meeting with Saeed & Little differs significantly from an initial consultation with a standard estate planning lawyer due to our firm’s distinctive methodology. A typical “first consultation” would be a meet-and-greet session during which the attorney would explain the different legal paperwork you need to create and give you a price estimate for doing so.

It will probably be quite challenging for you to understand exactly what you need for your particular family situation, assets, and decision-making process in those discussions, beyond merely determining whether the price of these documents is within your means. You’re more likely to get a set of documents that won’t serve and safeguard your family or your assets when they need it the most if you base your decision on what you need only based on the cost of the documents.

We’ve seen it all too often, but it’s unfortunate: Despite your best efforts, you either fail to create a will or trust or deal with a lawyer who creates a documents-only plan that amounts to little more than what you could create on your own using an online document provider. Your family is then left in a mess if you become incapacitated or pass away because they don’t know where your assets are, they don’t know who to contact, your paperwork is outdated, and your loved ones are simultaneously disoriented, confused, and sad.

Our entire estate planning procedure, which we call Life & Legacy Planning, has been created to support a completely different reality, in which you utilize it to not only build a plan for the people you care about when you pass away, but to also improve your life right now.

Known as a Family Wealth Planning Session, our initial appointment with you is a two-hour working session. You will inform us of all of your possessions and family dynamics during this session, and we will advise you of how the law would apply to you, your assets, and your family in the event of your incapacity or passing. Then, in order to ensure that your family never feels lost, confused, or alone during a time of bereavement, we will work together to design a plan for how to manage your affairs, how you’d like your family to be supported, and how to maintain track of your assets. And when you leave the session, you’ll feel relieved, taken care of, and more knowledgeable than ever about how to live your life.

Checkout these other articles!

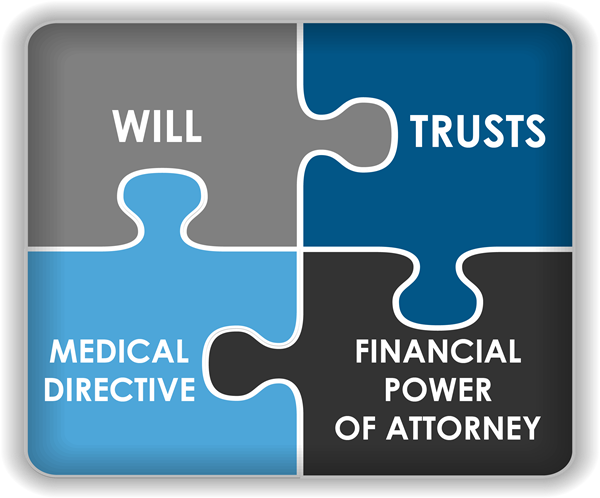

What Documents Can We Prepare?

What Documents Can We Prepare?

Foundational Documents

A Will

Financial Power Of Attorney

Medical Power Of Attorney

A Living Will (also called an Advanced Directive)

Living Trusts

Irrevocable Trusts and Revocable Trusts

Asset Protection Trusts

Real Estate Trusts

Special Needs Trusts

Educational Trusts or Student Fund Trusts

Pet & Gun Trusts

Beneficiary’s Deed

Also called a “Transfer On Death Deed.” You name the beneficiaries that will receive any real estate property upon your death. A beneficiaries deed is paired with your living will. This is a great method for avoiding probate and transferring real estate without a trust. Always consult your estate planning attorney.

Ali Saeed

Estate Planning Attorney

Advising You Step By Step!

We work together with our clients to make sure your wishes are carried out, so although we provide important estate planning documents, we are not just document producers. We care about our clients well-being, and hope our clients too feel the same. I look forward to connecting!

Ali Saeed

Estate Planning Attorney

Advising You Step By Step!

We work together with our clients to make sure your wishes are carried out, so although we provide important estate planning documents, we are not just document producers. We care about our clients well-being, and hope our clients too feel the same. I look forward to connecting!

What Clients Say About Ali

⭐️⭐️⭐️⭐️?

Would you rather talk with an attorney before scheduling?

Request A Callback

Would you rather talk with an attorney before scheduling?

Request A Callback

Ali will call you back shortly.

Questions Your Attorney Will Ask…

Questions Your Attorney Will Ask…

✅ List of Assets, including approximate value – if you have investment assets, please bring a recent statement from the brokerage house that holds the assets

✅ A recent bank statement

✅ List of names, addresses, and phone numbers for those to whom you plan on leaving assets in a will – usually this is children, relatives, or even charities

✅ A copy of the deed to any real estate you own – if you can find it

✅ Decide who you want to use as your agent under a power of attorney, and that person’s name, address, and phone number, if not included above

✅ Decide who you want to be in charge of distributing your assets upon your death, including that person’s name, address, and phone number, if not included above

✅ List of Assets, including approximate value – if you have investment assets, please bring a recent statement from the brokerage house that holds the assets

✅ A recent bank statement

✅ List of names, addresses, and phone numbers for those to whom you plan on leaving assets in a will – usually this is children, relatives, or even charities

✅ A copy of the deed to any real estate you own – if you can find it

✅ Decide who you want to use as your agent under a power of attorney, and that person’s name, address, and phone number, if not included above

✅ Decide who you want to be in charge of distributing your assets upon your death, including that person’s name, address, and phone number, if not included above

Book Now

In-Person, Audio or Video Conference

Would you rather talk with an attorney before scheduling?

Ali Saeed will reach out to you shortly.

Ali Saeed will reach out to you shortly. Complete this form to send us a message. Everything submitted through this form is fully confidential and we will reach back out to you promptly.

Complete this form to send us a message. Everything submitted through this form is fully confidential and we will reach back out to you promptly. Book A Call With Eric

Book A Call With Eric