Estate & Trust Administration

Trust Us to Help Plan Your Estate

_____________

Have a question about your will or trust but don’t know where to start?

Mobile Estate Planning

We’ll Come To You

_____________

Have a question about your will or trust but don’t know where to start?

PROTECT YOUR FAMILY

PROTECT YOUR FAMILY

What Is Estate & Trust Administration in Indiana?

Executors and trustees face a monumental responsibility. Estate and trust administration can be complex and difficult to navigate without assistance. If you have been designated as an executor or trustee of an estate, you now bear a significant amount of responsibility. There are specific tasks that must be completed by executors to ensure that the assets are both managed and distributed properly and lawfully. Failure to follow these rules means you could be held personally liable to the beneficiaries. There are certain disbursement protocols for each type of asset and the appropriate method depends on the type of asset, how it was owned, the named beneficiary, and its assessed value.

Executors and trustees often encounter other hurdles as well, such as creditors’ claims to assets and lawsuits that impact an estate. Our office has experienced probate lawyers who provide legal guidance with probate and estate administration to help ease the responsibility of trustees and executors.

Issues related to probate and estate administration can be confusing and intimidating. We represent executors and trustees in all facets of estate and trust administration. Our team of experts can assist with the following estate services:

- Limit liability exposure to beneficiaries and creditors

- Administer wills and trusts in probate court

- Assist in avoiding probate when possible

- Resolve and/or close estate and trust administrations through informal family settlement agreements or court accounting process

- Provide estate planning options to avoid probate court

- Ensure a proper transfer of assets

Families and Trustees need to be aware of the administrative tasks and costs associated with trust administration. One of the most prevalent situations when trust provisions call for the trust to be divided into sub-trusts (most frequently between a Survivor’s Trust and a Bypass Trust) from a joint trust between a husband and a wife. These trusts are frequently used for estate tax planning, surviving spouse asset protection, and divorce-and-remarriage protection for the estate portion of the first to pass away.

To be a successful trustee, you need to know a lot of things, and it’s very typical for trustees to make mistakes and break the law without even realizing it. Working with our estate administration team can be a wonderful method to:

Educate yourself on the requirements that the law places on a trustee.

Learn how to best carry out the duties that come with being a trustee.

assist the trustee in completing the necessary documents

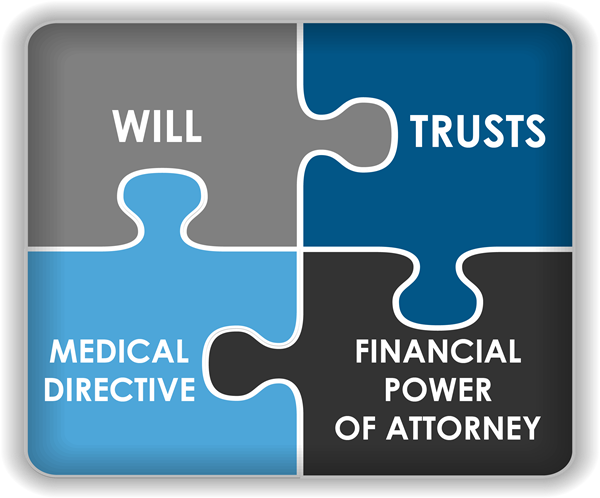

What Documents Can We Prepare?

What Documents Can We Prepare?

Foundational Documents

A Will

Financial Power Of Attorney

Medical Power Of Attorney

A Living Will (also called an Advanced Directive)

Living Trusts

Irrevocable Trusts and Revocable Trusts

Asset Protection Trusts

Real Estate Trusts

Special Needs Trusts

Educational Trusts or Student Fund Trusts

Pet & Gun Trusts

Beneficiary’s Deed

Also called a “Transfer On Death Deed.” You name the beneficiaries that will receive any real estate property upon your death. A beneficiaries deed is paired with your living will. This is a great method for avoiding probate and transferring real estate without a trust. Always consult your estate planning attorney.

Ali Saeed

Estate Planning Attorney

Advising You Step By Step!

We work together with our clients to make sure your wishes are carried out, so although we provide important estate planning documents, we are not just document producers. We care about our clients well-being, and hope our clients too feel the same. I look forward to connecting!

Ali Saeed

Estate Planning Attorney

Advising You Step By Step!

We work together with our clients to make sure your wishes are carried out, so although we provide important estate planning documents, we are not just document producers. We care about our clients well-being, and hope our clients too feel the same. I look forward to connecting!

What Clients Say About Ali

⭐️⭐️⭐️⭐️?

Would you rather talk with an attorney before scheduling?

Request A Callback

Would you rather talk with an attorney before scheduling?

Request A Callback

Ali will call you back shortly.

Questions Your Attorney Will Ask…

Questions Your Attorney Will Ask…

✅ List of Assets, including approximate value – if you have investment assets, please bring a recent statement from the brokerage house that holds the assets

✅ A recent bank statement

✅ List of names, addresses, and phone numbers for those to whom you plan on leaving assets in a will – usually this is children, relatives, or even charities

✅ A copy of the deed to any real estate you own – if you can find it

✅ Decide who you want to use as your agent under a power of attorney, and that person’s name, address, and phone number, if not included above

✅ Decide who you want to be in charge of distributing your assets upon your death, including that person’s name, address, and phone number, if not included above

✅ List of Assets, including approximate value – if you have investment assets, please bring a recent statement from the brokerage house that holds the assets

✅ A recent bank statement

✅ List of names, addresses, and phone numbers for those to whom you plan on leaving assets in a will – usually this is children, relatives, or even charities

✅ A copy of the deed to any real estate you own – if you can find it

✅ Decide who you want to use as your agent under a power of attorney, and that person’s name, address, and phone number, if not included above

✅ Decide who you want to be in charge of distributing your assets upon your death, including that person’s name, address, and phone number, if not included above

Book Now

In-Person, Audio or Video Conference

Would you rather talk with an attorney before scheduling?

Ali Saeed will reach out to you shortly.

Ali Saeed will reach out to you shortly. Complete this form to send us a message. Everything submitted through this form is fully confidential and we will reach back out to you promptly.

Complete this form to send us a message. Everything submitted through this form is fully confidential and we will reach back out to you promptly. Book A Call With Eric

Book A Call With Eric